AMERICAN EXPRESS (AXP)·Q4 2025 Earnings Summary

American Express Q4 2025: Revenue Tops Estimates, EPS Misses as Gen-Z Strategy Gains Traction

January 30, 2026 · by Fintool AI Agent

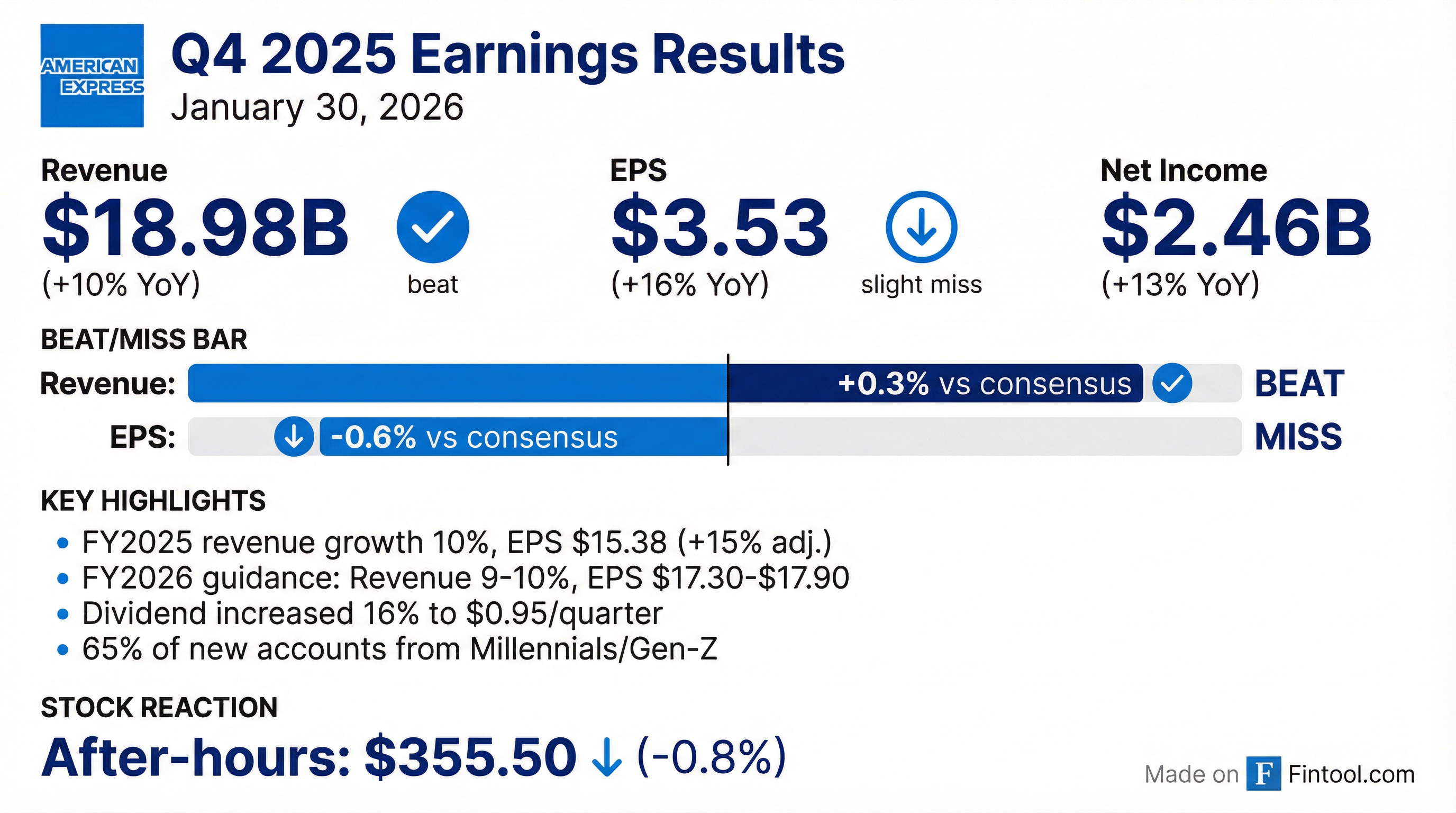

American Express delivered mixed Q4 2025 results, posting revenue of $18.98 billion (+10% YoY) that edged past consensus while EPS of $3.53 fell slightly short of the $3.55 estimate. The quarter capped a strong FY2025 with 10% revenue growth and adjusted EPS growth of 15%. Management guided FY2026 EPS of $17.30-$17.90, with the midpoint above Street expectations, and announced a 16% dividend increase.

Did American Express Beat Earnings?

American Express delivered a split decision in Q4 2025 — revenue beat modestly while EPS came in just below expectations. CEO Steve Squeri opened with confidence: "We had another year of strong performance, continuing the momentum we delivered since introducing our long-term growth aspirations in January of 2022."

For full-year 2025, AXP delivered $72.2 billion in revenue (+10% YoY) and EPS of $15.38 (+15% YoY adjusted for the prior year Accertify gain).

Recent Beat/Miss History:

Values retrieved from S&P Global

AXP has beaten EPS estimates in 6 of the last 8 quarters and revenue in 5 of the last 8 quarters.

What Did Management Guide?

American Express provided FY2026 guidance that topped consensus expectations:

Values retrieved from S&P Global

Management also reiterated their long-term aspiration of 10%+ revenue growth and mid-teens EPS growth.

The FY2026 EPS guidance midpoint of $17.60 implies 14% growth over FY2025's $15.38, consistent with their mid-teens aspiration. The 9-10% revenue guidance acknowledges potential macro uncertainty while maintaining confidence in their premium model.

How Did the Stock React?

American Express shares showed muted post-earnings movement:

- Pre-earnings close (Jan 29): $358.50

- After-hours: $355.50 (-0.8%)

- YTD performance: +9.4% (from ~$328 at year-end 2025)

- 52-week range: $220.43 - $387.49

The relatively flat reaction suggests the market viewed results as largely in-line with expectations. The slight EPS miss was offset by strong guidance and continued momentum in premium card acquisitions.

Historical earnings day reactions:

What Changed From Last Quarter?

Key differences versus Q3 2025:

-

Card Member Services expense surged 53% YoY — driven by new U.S. Platinum benefits introduction and higher benefit utilization

-

Net card fee growth decelerated to 16% (vs 17% in Q3) on an FX-adjusted basis, though still strong

-

Write-off rates ticked higher — Card Member Receivables net write-off rate rose to 1.5% (vs 1.3% in Q3), partially due to a fraud event within U.S. Consumer segment

-

Technology spend increased — FY2025 tech spend reached $5.0 billion, up from $4.5 billion in FY2024, reflecting AI and digital investments

Segment Performance

Billed Business by Segment (Q4 2025 FX-adjusted YoY growth):

Generational breakdown is the story — within U.S. Consumer:

- Gen-Z: +38% YoY growth (6% of billings)

- Millennials: +12% YoY (30% of billings)

- Gen-X: +8% YoY (36% of billings)

- Baby Boomers+: +2% YoY (28% of billings)

65% of global new accounts acquired came from Millennials and Gen-Z, and 73% were on fee-paying products. Digital self-servicing investments are paying off: "Over the last 3 years, the number of calls per account coming into our service centers has dropped by 25%."

Revenue Breakdown

Q4 2025 Revenue Composition:

Net card fees continue to be the standout — growing at 17% CAGR since Q4 2019, driven by premium card portfolio expansion and fee increases. CFO Christophe Le Caillec noted: "In 2026, we expect card fees, card fee growth to pick up as the year progresses, as we see the impact from the Platinum refresh, exiting the year in the high teens."

Net interest income grew 12%, benefiting from revolving loan balance growth partially offset by lower interest rates. Management expects "NII growth to continue to outpace growth in loans and receivables in 2026."

Credit Quality

Credit metrics remained stable with some uptick in write-offs:

Management noted the Q4 Card Member Receivables write-off increase (to 1.5%) was partially driven by a fraud event within the U.S. Consumer segment.

Total provision of $1.41 billion included $1.27 billion in net write-offs and a $141 million reserve build.

Capital Return

American Express continues to return substantial capital to shareholders:

Dividend increased 16% to $0.95/quarter — the third consecutive double-digit dividend increase. Over the past 3 years, quarterly dividend has grown 58%.

71% of net income returned to shareholders over the 3-year period (Q1'23 to Q4'25). CET1 ratio of 10.5% remains within the 10-11% target range.

Strategic Highlights

Key initiatives highlighted by management:

-

Third-Generation Data Platform — Rolling out new data and analytics platform built on public cloud, "reducing the time for key processes in marketing and fraud by 90%." Full migration expected by 2027.

-

Product Refresh Strategy — Refreshed products in "close to a dozen countries," including new U.S. Consumer and Small Business Platinum cards with enhanced benefits (Lululemon, Resy, Walmart+, hotel credits).

-

Merchant Network Expansion — Expanded global merchant acceptance to over 170 million locations worldwide.

-

Restaurant & Dining Assets — Resy restaurant spending up 20%, with management planning to combine Resy and Tock acquisitions. Squeri noted: "That synergy has really worked out very, very well for us."

-

Gen AI Deployment — "Travel Counselor Assist" tool and "Dining Companion" experience launched, with Gen AI tools deployed to "nearly all our colleagues worldwide."

Operating Efficiency

Operating expense leverage continues to improve:

*FY2024 adjusted to exclude Accertify gain

Variable customer engagement (VCE) expenses were 45% of revenue in Q4, up from 43% for full-year as the company invested in new Platinum benefits and partner payments. For 2026, management guided VCE to revenue ratio around 44%, operating expenses growing mid-single digits, and marketing expense up low single digits as product value proposition investments drive acquisition efficiencies.

Key Risks and Concerns

Management flagged several considerations in their forward-looking statements:

-

Macro sensitivity — Guidance subject to macroeconomic environment including unemployment, GDP, interest rates, and geopolitical factors

-

Credit normalization — Write-off rates ticking up, though still below pre-pandemic levels; fraud event contributed to Q4 uptick

-

VCE expense pressure — New Platinum benefits driving Card Member Services expense up 53% YoY in Q4

-

Commercial segment weakness — U.S. SME and Corporate billings grew only 3-4%, lagging consumer

-

FX headwinds — Strong dollar reducing reported growth by ~1 percentage point

Q&A Highlights

On Platinum Card Success — Steve Squeri called the refresh "a wildly successful product launch. It attracted new cardholders, and it engaged existing cardholders to spend even more." The Platinum travel app drove a 30% uptick in travel bookings in Q4.

On Marketing Efficiency — When asked about net new cards acquired declining, Squeri explained they "redirected marketing investments away from lower-cost cash back products to Platinum." The result: "some of the lowest cost of acquisition for Platinum in the last two years" and fee-paying cards as a percentage of U.S. Consumer NCA up 8 percentage points year-over-year.

On Premium Customer Demographics — The average age of new customers is 33 on U.S. Consumer Platinum and 29 on U.S. Consumer Gold, giving AXP "a long runway to grow our relationships with these customers over time." Millennials and Gen Z now make up the largest share of U.S. consumer spending.

On Competition in SMB — Squeri addressed Capital One's acquisition of Brex: "It's a highly competitive space... having said that, we're still three times larger than anybody else." AXP's Center acquisition will launch by mid-year 2026 as part of a suite for small and middle-market commercial customers.

On 10% Credit Card Cap Proposal — Squeri was direct: "I don't think a 10% credit card cap is the answer... It would reduce the number of cards ultimately in the marketplace. I think it would reduce line sizes. America pretty much runs on credit."

On Competitive Dynamics — "The challenge for us has been the challenge that we've faced for the last 15 years, is to stay one or two or three steps ahead of our competitors... when you look at what our competitors are doing, they are following our playbook."

On Cost to Grow Concerns — When asked if the market is overheated, Squeri responded: "I don't view this as an overheated market in any way, shape, or form for us. It's competitive, no doubt, but I don't think it's overheated from a cost perspective." He emphasized AXP's consistent delivery of 10% revenue growth and mid-teens EPS growth for five consecutive years.

The Bottom Line

American Express delivered a solid finish to FY2025 with revenue growth of 10% and adjusted EPS growth of 15%, meeting or exceeding its long-term aspirations. The slight Q4 EPS miss was driven by elevated Card Member Services expenses from new Platinum benefits — an investment CEO Squeri called "wildly successful" given the engagement metrics. The Gen-Z and Millennial acquisition engine continues to fire, with 65% of new accounts from younger demographics and average new Platinum customer age of just 33. FY2026 guidance above consensus suggests management confidence remains high despite macro uncertainties. The 16% dividend increase signals continued commitment to shareholder returns.

Related Links: